Payroll Services

Outsourced Payroll Services for Efficient Workforce Management

Payroll management is a critical function that directly impacts employee satisfaction, compliance, and overall business efficiency. From calculating wages and managing variable pay structures to handling leave, benefits, and statutory deductions, payroll requires precision, consistency, and up-to-date regulatory knowledge.

At Global Bookkeeping, we simplify payroll by delivering accurate, timely, and compliant outsourced payroll solutions tailored to businesses of all sizes. Our team manages the complete payroll lifecycle—ensuring employees are paid correctly and on schedule while maintaining full compliance with local and international labor and tax regulations.

Manual payroll processing or limited regulatory awareness can lead to errors, delayed payments, and compliance risks, all of which affect employee morale and expose businesses to penalties. By outsourcing payroll to our experts, organizations reduce administrative burden, eliminate inaccuracies, and gain confidence that payroll operations are handled professionally.

Our Payroll Management Workflow

Tailored Payroll Services

At Global Bookkeeping, our payroll solutions are designed around the unique structure and operational needs of your business. We help organizations reduce compliance risks, improve payroll accuracy, and maintain cost efficiency—allowing you to focus on growth while we manage the complexities of payroll administration.

Our Payroll Services Include:

Payroll Data Entry and Processing

Net Pay and Tax Withholding Calculations

Timely Payslip Generation and Distribution

Payroll Recordkeeping and Administration

Statutory Returns and FilingsPeriodic Compliance Reporting

Employee Benefits and Insurance Deductions

Benefits of Outsourcing Payroll to Grover Business Consultants

Outsourcing your payroll to Global Bookkeeping gives your business access to a highly skilled payroll team committed to accuracy, compliance, and operational excellence.

Key Benefits of Our Outsourced Payroll Services:

High Accuracy and Reliability

Business-Specific Payroll Solutions

Enhanced Payroll Efficiency

Timely and Correct Employee Payments

Strict Data Security and Confidentiality

Proven Experience Across Markets

Multi-Jurisdictional Compliance Confidence

Our Workflow to manage Payroll:

1. Employee Data Onboarding

We begin by securely collecting and validating employee information, including personal details, compensation structure, employment terms, and statutory data. This ensures payroll records are accurate and compliant from day one.

2. Time, Attendance, and Leave Management

Working hours, overtime, and leave data are captured through reliable time-tracking systems or client-provided records. This step ensures precise calculation of payable hours and adherence to company policies.

3. Payroll Computation

Using verified inputs, we calculate salaries and wages based on hourly rates or fixed compensation structures. Variable components such as overtime, bonuses, and commissions are incorporated accurately.

5. Net Pay Determination

After applying deductions, net pay is computed to determine the final payable amount to each employee—ensuring transparency and accuracy.

7. Payroll Tax Filing and Regulatory Reporting

We manage timely preparation and filing of required payroll returns, including periodic tax filings and year-end statutory reports for employees and contractors.

9. Payroll Review and Audit Support

Regular payroll reviews and internal checks are conducted to verify accuracy, prevent discrepancies, and strengthen internal controls. We also provide audit support when required.

4. Statutory Deductions and Withholdings

All applicable deductions are calculated in line with current regulations, including payroll taxes, social security contributions, employee benefits, and any other statutory or authorized deductions.

6. Payroll Processing and Salary Disbursement

Payroll is processed efficiently, and payments are executed through secure channels such as direct deposit or other approved payment methods, ensuring employees are paid on time.

8. Payroll Record Management and Compliance

Comprehensive payroll records are maintained in accordance with statutory retention requirements, ensuring audit readiness and regulatory compliance.

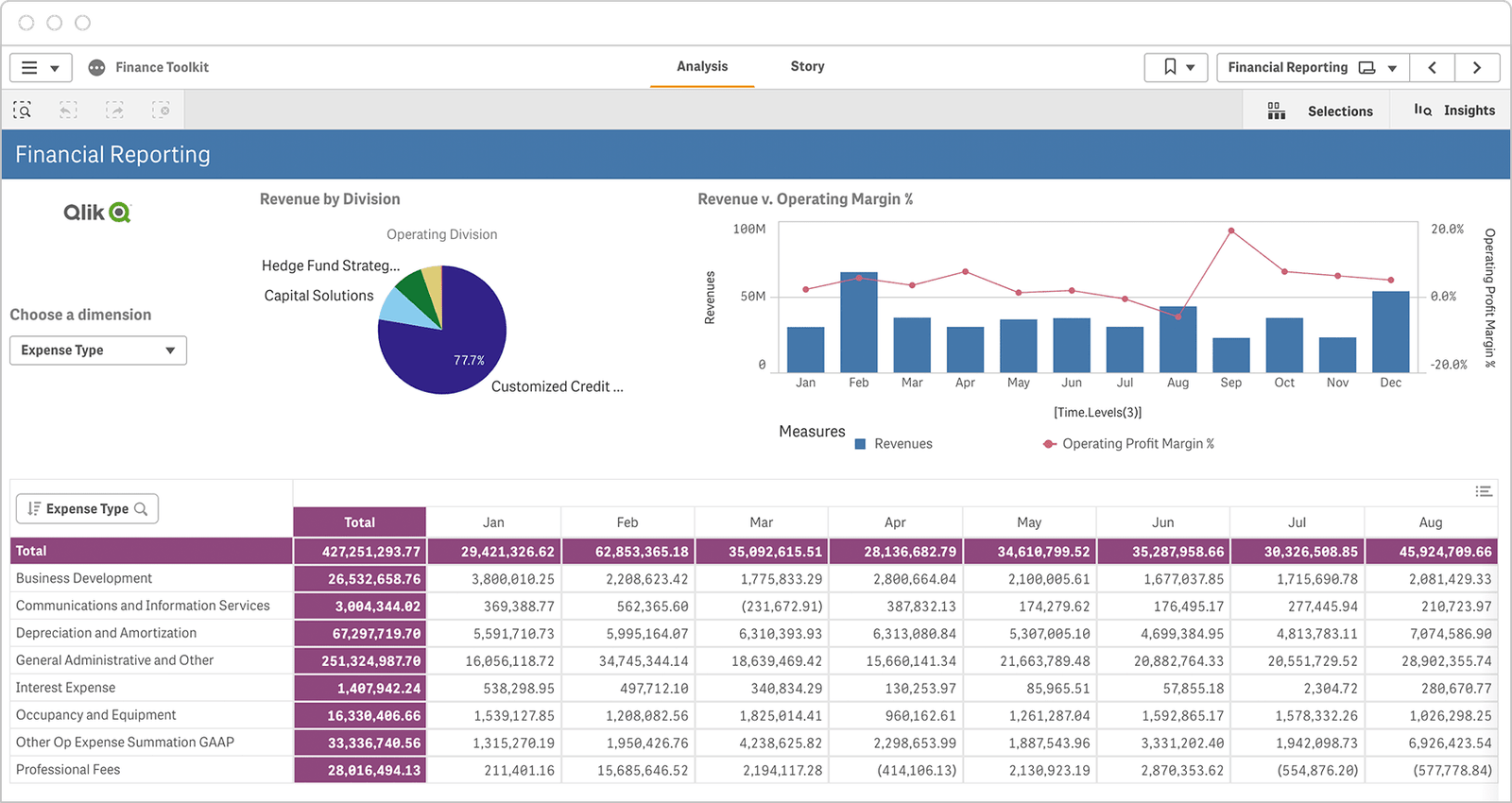

10. System Integration and Financial Reporting

Our payroll processes integrate seamlessly with accounting, HR, and benefits systems—ensuring accurate financial reporting and a unified view of payroll-related data.

Our customized payroll solutions are supported by experienced professionals and a strong understanding of local and international payroll regulations.We ensure accurate calculations, timely processing, and full compliance—minimizing risk and enhancing operational confidence.By removing the administrative burden of payroll processing, we allow your teams to focus on strategic priorities while we handle the operational complexities with precision and care.